Life Insurance Advertising Trends: Stay Informed With PowerAdSpy

Life insurance, a vital aspect of financial planning, requires innovative and effective advertising strategies to connect with potential customers. Whether you’re an insurance agent, marketer, or business owner, understanding the latest advertising trends can make all the difference in reaching your target audience and driving meaningful engagement.

But keeping a note of the latest trends in ads could be a lengthy process. In today’s ever-evolving digital landscape, advertisements come and go faster than ever before.

Tracking the constantly changing strategies of successful campaigns can be challenging, especially when you’re juggling the responsibilities of an insurance agent, marketer, or business owner.

This is where PowerAdSpy steps in as your indispensable ally. It is an all-in-one solution for not just keeping up with the trends but staying one step ahead in the world of life insurance advertising.

In this blog, we’ll dive deep into the ever-evolving world of life insurance advertising, uncover the latest Facebook ads trends, and show you how PowerAdSpy can revolutionize your approach to advertising.

Listen To The Podcast Now!

Understanding The Importance Of Life Insurance Ads

To truly grasp the significance of life insurance ads, one must first recognize the pivotal role they play in our financial security and peace of mind.

Life insurance, often deemed a cornerstone of responsible financial planning, serves as a safety net for individuals and their loved ones, offering a shield against life’s unpredictable twists and turns.

But, as powerful as life insurance itself may be, its efficacy largely depends on the effectiveness of its advertising campaigns.

The Power of Life Insurance Ads:

Educating and Informing:

Life insurance ads are not just promotional tools; they are educators. They demystify the complexities of life insurance, making it accessible to the masses. These ads convey the “why” and the “how” of life insurance, shedding light on its importance in safeguarding one’s family and legacy.

Creating Awareness:

The landscape of life insurance is vast and varied, offering a plethora of policies tailored to diverse needs. Life insurance ads serve as beacons, illuminating the various options available, and ensuring individuals make informed choices that align with their unique circumstances.

Building Trust:

Trust is the cornerstone of the insurance industry. A well-crafted life insurance ad can instil confidence in potential policyholders, assuring them that their financial future is in secure hands. Trust, once earned, can be the bridge that leads to a lifelong relationship between insurers and their clients.

Generating Leads:

In the competitive world of insurance, leads are akin to gold. Life insurance ads are instrumental in attracting potential customers actively seeking coverage. By crafting compelling and persuasive advertisements, insurers can cultivate a steady stream of prospects.

Gaining a Competitive Edge:

In a market teeming with choices, differentiation is key. Effective advertising not only distinguishes one insurer from another but also highlights the unique selling points of their policies. This competitive edge can make all the difference in attracting discerning customers.

Challenges and Complexities:

While the importance of life insurance advertisement is undeniable, the challenges of creating and maintaining effective campaigns are formidable:

Changing Demographics:

As demographics shift, so do the needs and preferences of potential policyholders. Life insurance ads must adapt to address these evolving dynamics.

Digital Transformation:

The digital revolution has reshaped the advertising landscape. Life insurance ads now contend with a multitude of online platforms, each requiring tailored strategies to reach the right audience effectively.

Shifting Consumer Behavior:

Consumer behaviour is a moving target, influenced by technology, social media, economic conditions, and more. Understanding these shifts is essential for crafting relevant and compelling life insurance ads.

Intense Competition:

The life insurance sector is highly competitive, with companies vying for the attention of a limited pool of potential clients. Crafting standout ads is essential to rising above the noise.

In light of these complexities, the need for innovative tools and strategies to navigate the world of life insurance advertising has never been greater.

Enter PowerAdSpy, a potent ally in the quest for advertising excellence. In the following sections, we will explore how

This, a Facebook ads intelligence tool, can revolutionize the way insurers approach their advertising campaigns, helping them adapt to evolving trends and gain a competitive edge in this ever-evolving landscape.

Introducing PowerAdSpy: Your Facebook Ads Spy Tool

PowerAdSpy is an Al-based ad intelligence tool that can help life insurance companies overcome the challenges of staying informed about advertising trends. It is designed for Facebook ads, and it allows businesses to gain deep insights into their competitors’ strategies and audience engagement patterns.

Now, let’s delve into how this can assist you in optimizing your life insurance advertising campaigns.

Discover Life Insurance Facebook Ads:

Explore a treasure trove of life insurance advertisements on Facebook. Unearth innovative campaigns, compelling creatives, and powerful messaging that drive success in the insurance industry.

Here’s how you can use it to uncover these ads:

Log In to PowerAdSpy:

Start by logging/Signing into your account or accessing the tool, if you haven’t already.

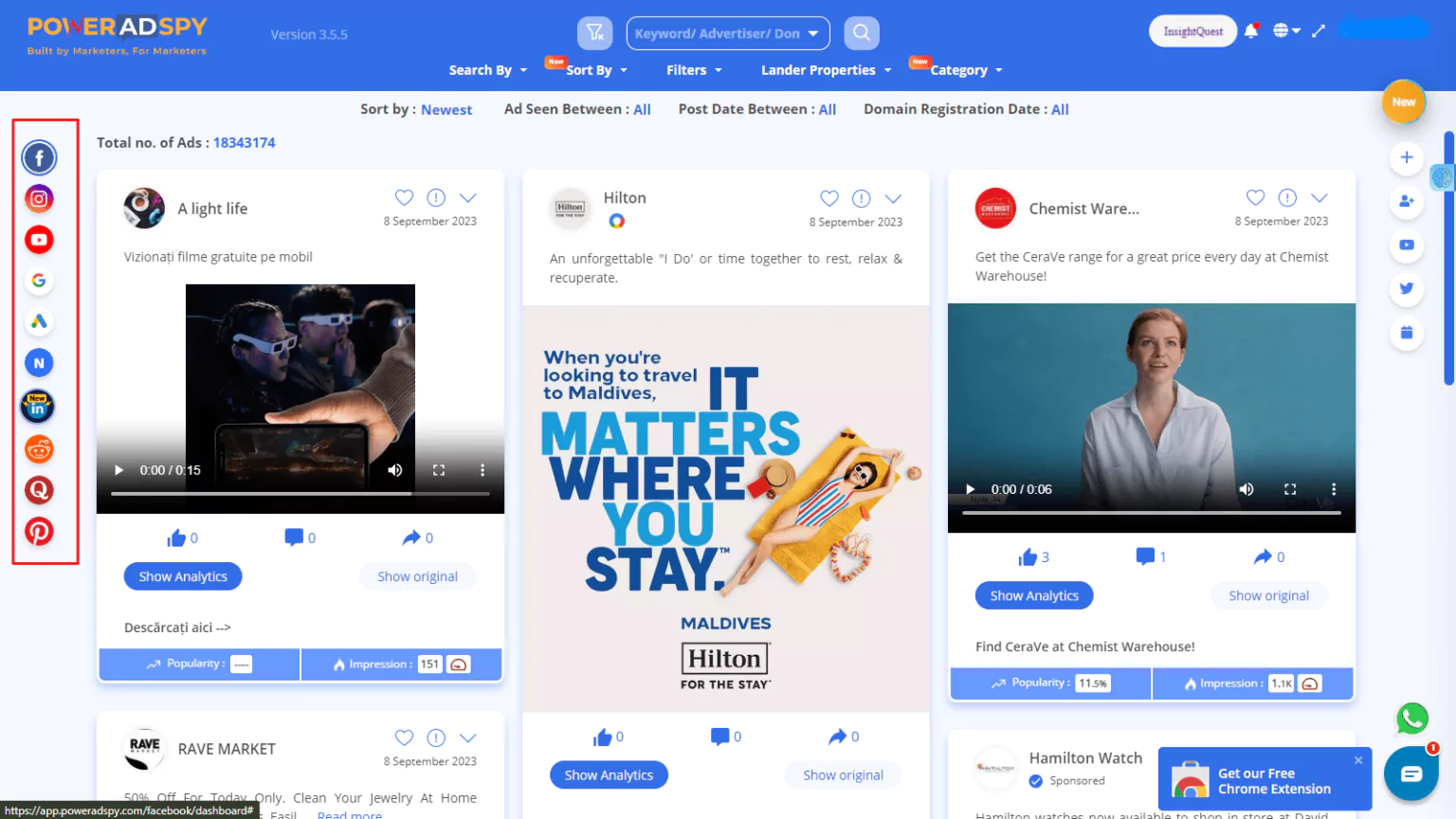

Access the Dashboard:

Once logged in, you will be directed to its dashboard, which is your central hub for ad research.

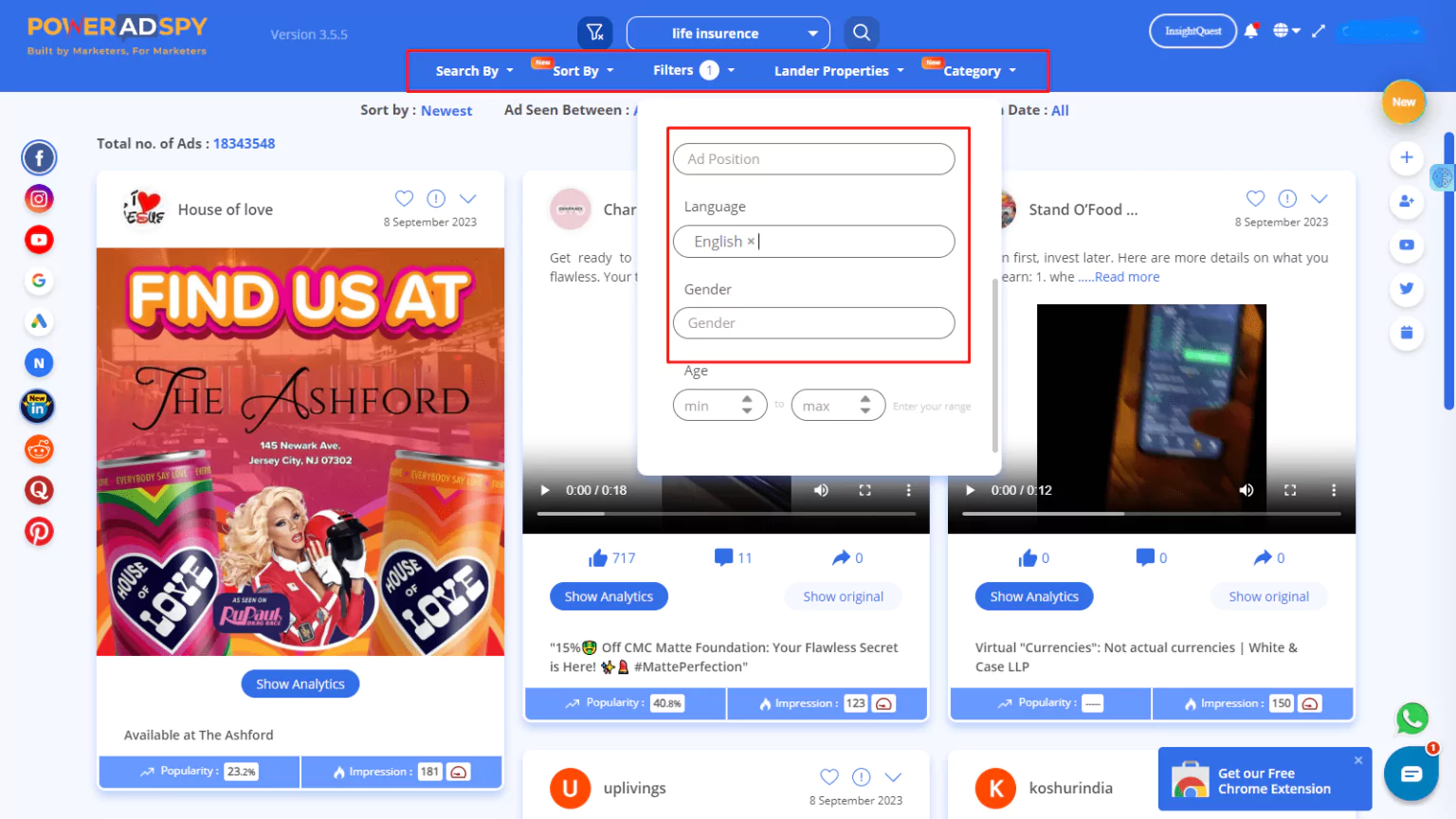

Set Your Search Filters:

- Look for the search bar or filter section within the dashboard. This is where you can specify your criteria for discovering life insurance Facebook ads.

- Consider using keywords related to life insurance, such as “life insurance,” “insurance policy,” “financial protection,” and other relevant terms.

- You can also refine your search by selecting the geographic location you want to focus on, ad type (Facebook), ad status (active or all), ad placements, and ad networks.

- Now, click on the “Search” button to begin your search based on the specified filters.

Review Search Results:

- It will generate a list of Facebook ads that match your criteria.

- Browse through the search results to discover various life insurance ads used by different companies.

Analyze Ad Creatives:

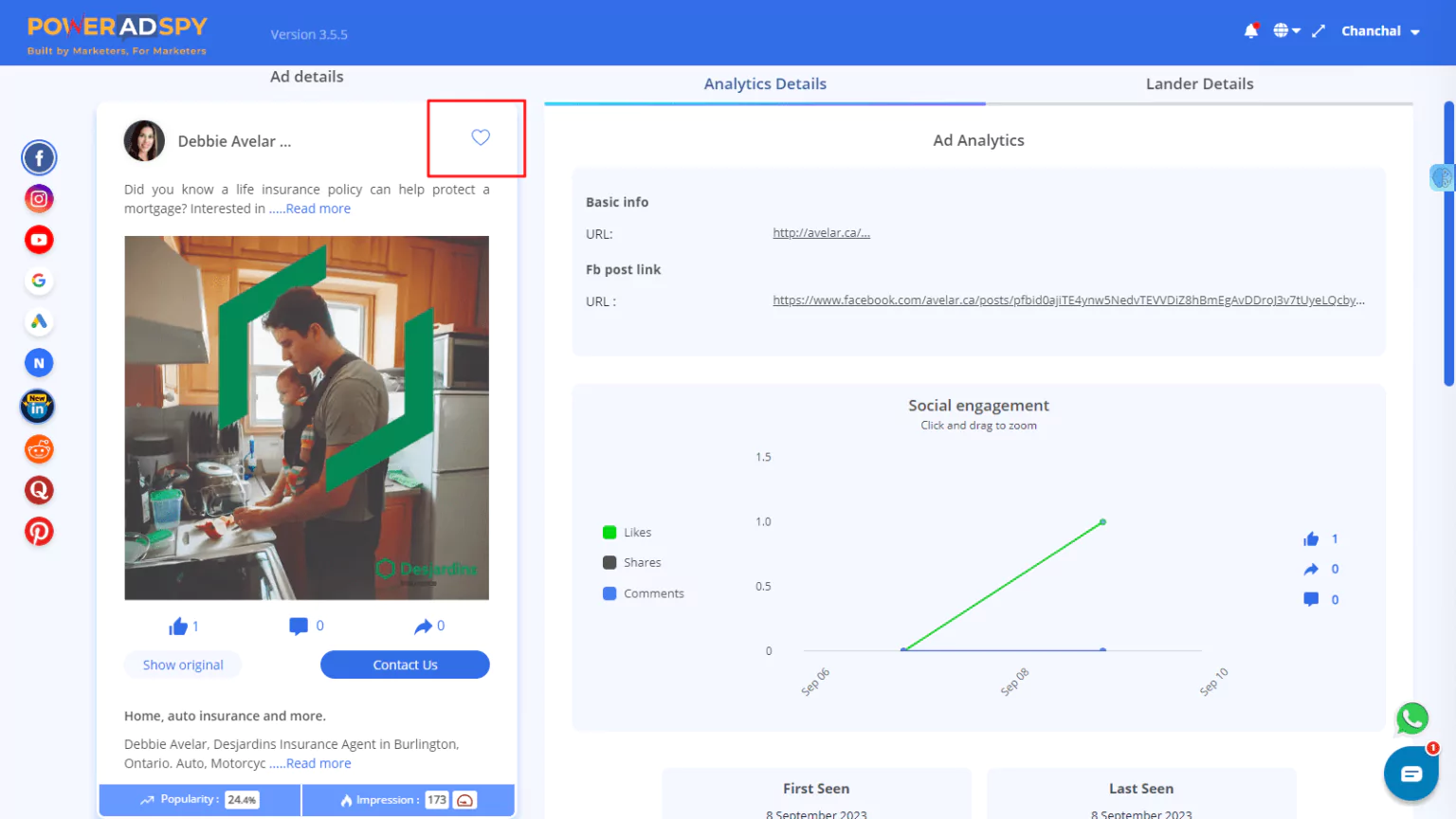

- Click on individual ads within the search results to access more detailed information.

- Analyze the Facebook ad creatives, including images, videos, and ad copies used by advertisers in the life insurance niche.

- Pay attention to the messaging and visual elements employed to convey the benefits of life insurance policies.

Examine Engagement Metrics:

- Check engagement metrics for each ad, including likes, comments, shares, and click-through rates.

- High engagement can indicate an effective ad campaign and may suggest elements worth incorporating into your own strategies.

Bookmark Ads:

If you come across competitor ads that are particularly noteworthy or inspiring, use it’s bookmark feature to save them for future reference.

Monitor Over Time:

Keep in mind that competitor research is an ongoing process. Regularly check PowerAdSpy to stay updated on the latest life insurance Facebook ads and changing trends.

Extract Insights and Refine Your Strategy:

- Use the insights gained from competitor ads to refine your own life insurance advertising campaigns.

- Consider testing and adapting elements that appear successful in your competitors’ ads.

By following these steps, you can effectively discover and analyze Life Insurance Facebook ads using an appropriate tool that can meet your needs.

This information will be invaluable in staying informed about advertising trends and improving your own advertising efforts in the competitive life insurance market.

Analyze Trends in Facebook Ads for Life Insurance:

Stay ahead of the curve by analyzing the latest trends in life insurance advertising. Understand what works, what resonates with audiences, and how to adapt your strategies for maximum impact.

Here’s how you can effectively analyze these trends:

Gather a Diverse Set of Ads:

It collects a wide range of life insurance Facebook ads from different companies and competitors. Ensure that your sample includes both established players and newer entrants.

Examine Ad Creatives:

Focus on the creative elements of the ads. Analyze the imagery, videos, and design styles used. Take note of any common themes or visual trends, such as:

Use of family and relationship imagery to convey security and protection.

Graphics or visuals representing financial stability and future planning.

Attention-grabbing visuals or unique ad formats.

Evaluate Ad Messaging:

Study the ad copy and messaging. Look for recurring themes or messaging styles, including:

Emphasis on peace of mind, security, and protection.

Highlighting the ease of getting coverage or the benefits of specific policies.

Calls to action encourage users to learn more, get a quote, or take action.

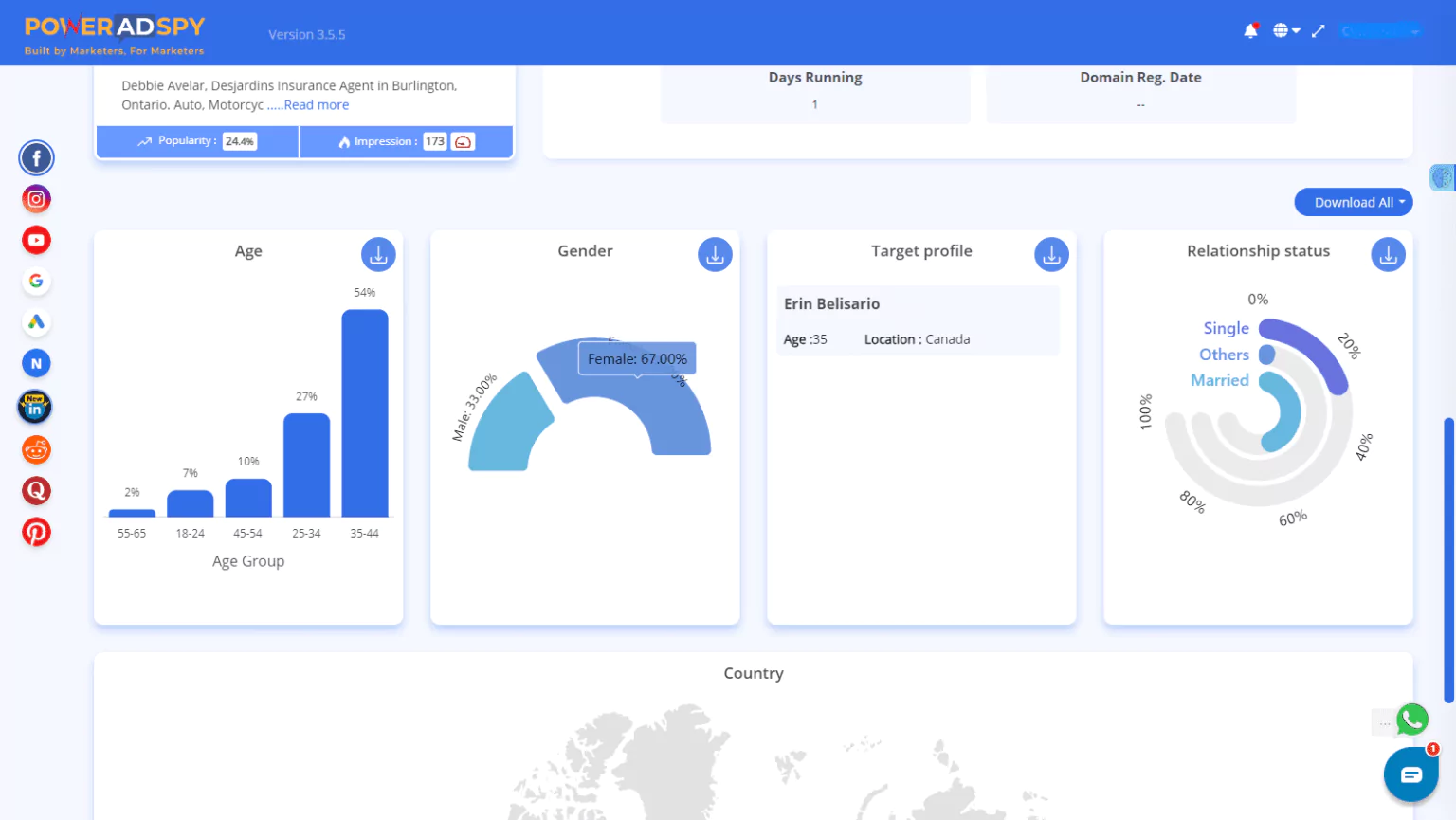

Analyze Targeting Strategies:

Investigate the audience targeting strategies employed in these ads. Note the demographics, interests, and behaviours that seem to be common among the ads’ intended audiences.

Pay attention to whether ads are tailored to specific life stages, such as marriage, parenthood, retirement planning, etc.

Engagement Metrics:

Examine engagement metrics for each ad, including likes, comments, shares, and click-through rates. Identify which ads are generating the most engagement.

Evaluate whether certain ad elements correlate with higher engagement levels.

Ad Format Trends:

Take note of any emerging ad formats or trends. For example, are carousel ads, video ads, or interactive ad formats gaining popularity in the life insurance sector?

Consider the effectiveness of different ad formats in conveying the message and engaging the audience.

Landing Page Analysis:

If possible, visit the landing pages linked to the ads. Assess the user experience, the clarity of the value proposition, and the ease of taking the desired action (e.g., getting a quote, or contacting an agent).

Competitor Comparison:

Compare the trends you’ve identified in your competitors’ ads with your own advertising strategies. Identify gaps or opportunities for differentiation.

By systematically analyzing trends in Facebook ads for life insurance, you can gain a deeper understanding of what works in the industry and refine your own advertising campaigns accordingly.

Stay vigilant, as trends in the digital advertising landscape can evolve rapidly, and the ability to adapt is a key driver of success.

Read More:

Latest Facebook Trends You Should Follow To Grow Your Business

07 Ways To Create Successful Facebook Ad Creative

7 Strategies for Decoding Competitor Ads

Monitor Competitors’ Strategies:

Gain a competitive edge by keeping a close eye on your rivals. PowerAdSpy lets you dissect your competitors’ ad tactics, helping you refine your own approach and outshine them in the digital arena.

Here are steps and strategies to effectively monitor what your competitors are doing:

Regularly Review Ads:

Set up a regular schedule for reviewing your competitors’ ads. This could be weekly or monthly, depending on the level of competition and how frequently they change their ad campaigns.

Engagement Metrics:

Monitor the engagement metrics on these ads, such as likes, comments, shares, and click-through rates. High engagement may indicate effective messaging or targeting.

Ad Frequency and Duration:

Take note of how frequently your competitors are running specific ads and how long they’ve been active. This can give you insights into which campaigns are successful.

Seasonal Trends:

Identify any seasonal or cyclical patterns in your competitors’ advertising efforts. For example, certain types of life insurance policies may be promoted more during specific times of the year.

Benchmark Against Your Own Strategies:

Compare your findings with your own advertising strategies. Identify gaps and opportunities for improvement or differentiation.

Adapt and Test:

Use the insights gained from monitoring competitors to refine your own ad campaigns. Consider testing variations of your ads to see what resonates best with your target audience.

Stay Ethical and Compliant:

While monitoring competitors is essential, ensure that you stay ethical and within legal and industry compliance guidelines. Avoid any unethical or misleading practices.

Track Changes Over Time:

Keep a historical record of competitor ad changes. This can help you identify shifts in their strategies and adapt accordingly.

Continuous Learning:

Competitor analysis is an ongoing process. Stay vigilant and continue to learn from your competitors’ successes and failures.

Conclusion

Staying informed about the latest advertising trends is vital for the success of any life insurance company. The dynamic nature of the industry, coupled with changing consumer behaviour, makes this task challenging but essential.

PowerAdSpy, the Facebook ads intelligence tool, provides a powerful solution for monitoring life insurance Facebook ads, analyzing trends, and gaining insights into competitors’ strategies and audience engagement patterns.

By harnessing the capabilities of ad tools, life insurance companies can craft more effective and engaging ad campaigns that resonate with their target audience.

Whether you’re a seasoned player in the industry or a newcomer looking to make your mark, staying informed with This is the key to staying competitive and ensuring that your life insurance ads reach the right audience at the right time.